Do you see what I see?

Remember when we were kids, lying on our backs and staring at the clouds? One person would say they saw a bunny, while someone else swore it was a lion.

Pitching to investors is kind of like that.

Your startup’s potential might seem clear to you, but you need to make sure the investors see the same opportunity in the market as you do.

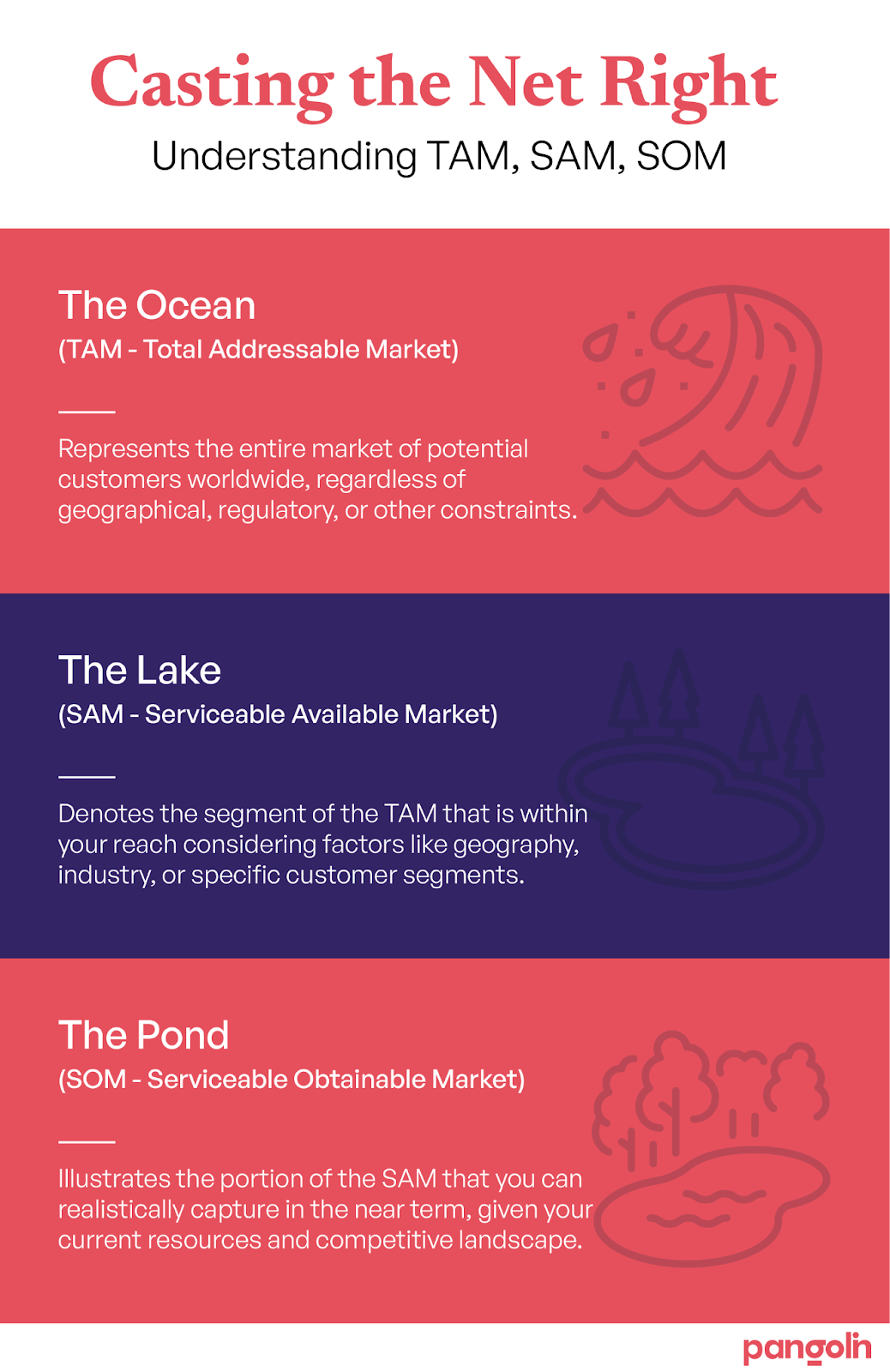

They’re already intrigued by your idea—otherwise, you wouldn’t be in the room. But now, your job is to guide them to see the right shapes in the clouds—your Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM).

It’s the part of your pitch where you show them whether your startup is playing in a sandbox or standing at the edge of a goldmine.

But here’s the tricky part: defining your market opportunity. Get it wrong, and you risk looking too broad or too narrow—both of which can turn investors off. That’s why nailing this part of your pitch is so crucial.

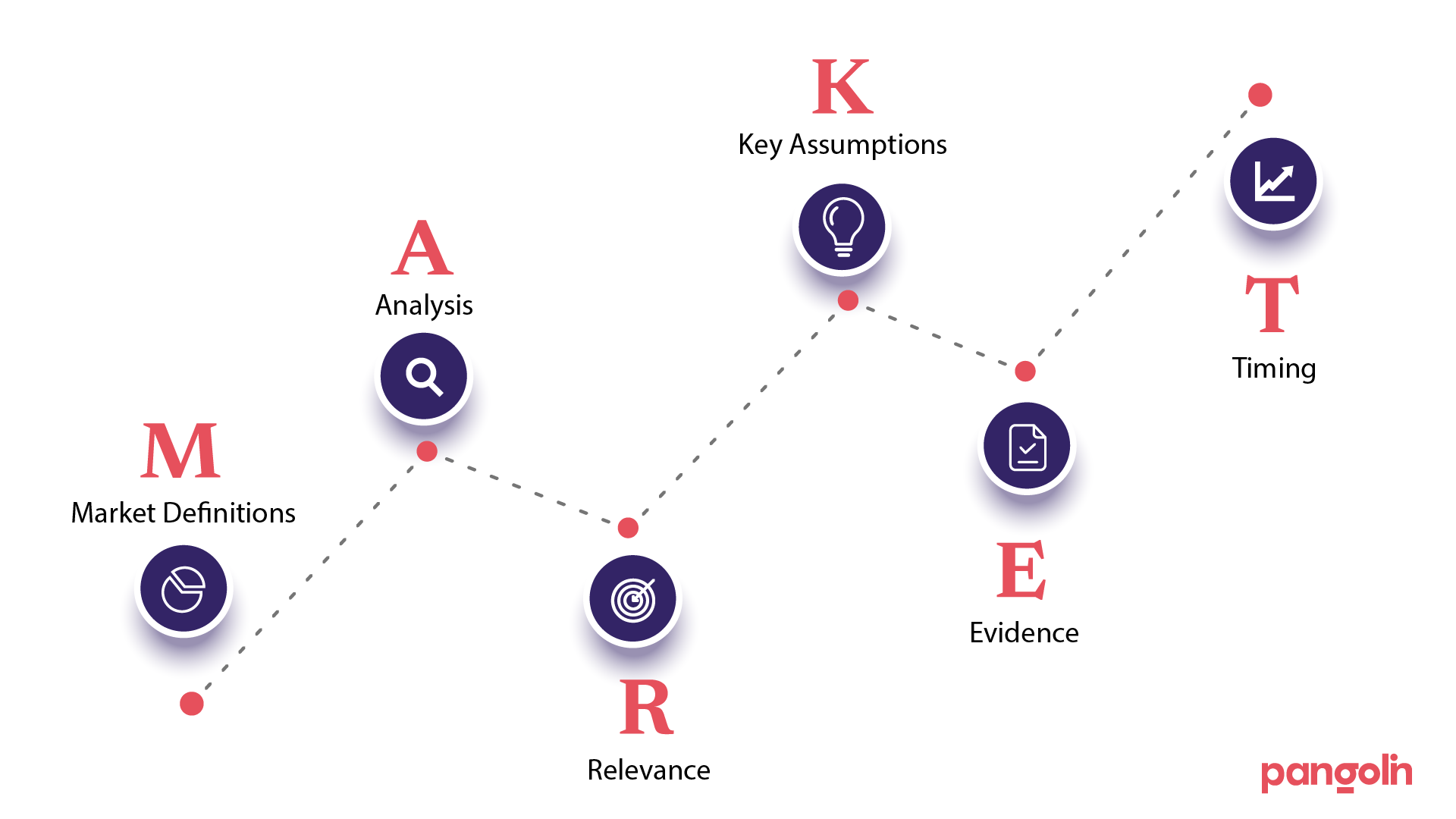

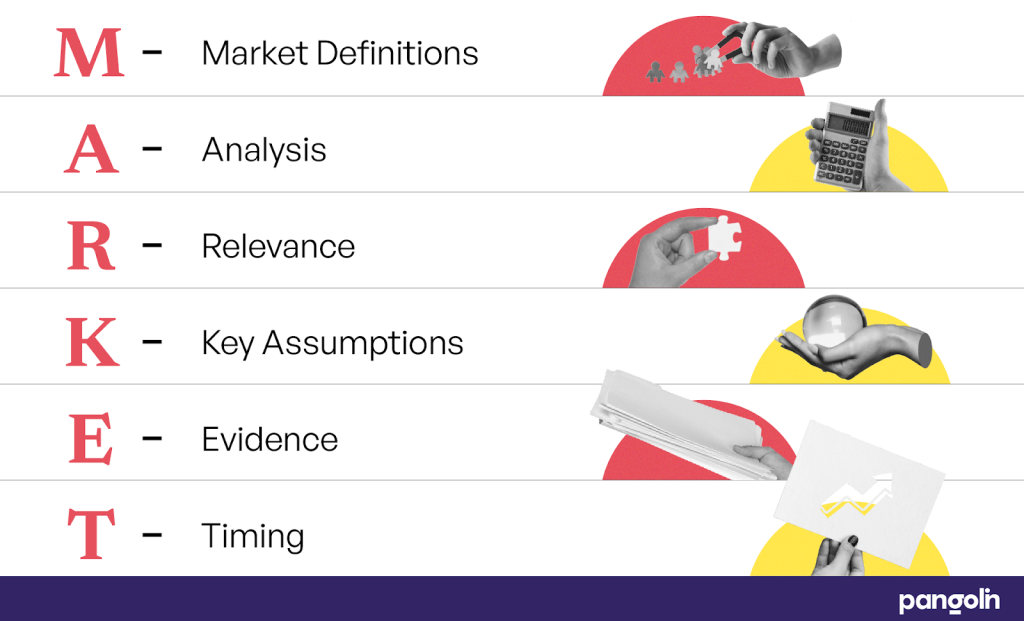

And this is where the MARKET framework comes in. It’s your blueprint for crafting a compelling TAM, SAM, SOM slide that not only impresses investors but convinces them that they’re seeing the same bright future you are.

M – Market Definitions

A – Analysis

R – Relevance

K – Key Assumptions

E – Evidence

T – Timing

Before getting into the first element of the MARKET framework, it’s important to understand why these market definitions matter so much.

Your TAM, SAM, SOM slide —it’s about telling a story.

It’s about showing investors the scale of the opportunity and how well you’ve thought through the potential of your product.

Now, let’s break down each component of the MARKET framework, starting with the first critical step—Market Definitions.

—

M – Market Definitions: Clarifying TAM, SAM, SOM

You’re in front of a group of seasoned investors, and you mention that your market is “everyone.”

Eyes glaze over, and you can almost hear the skepticism in the room.

Why?

Because saying your product is for everyone often means it’s for no one in particular.

Defining your Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) is a chance to show investors that you’ve done your homework.

It’s your opportunity to pinpoint exactly where your startup fits in the market landscape.

- TAM is like the universe of potential customers—the big picture.

- SAM narrows it down to those who might actually be interested in your solution.

- SOM is where the rubber meets the road—the segment you can realistically capture.

Actionable Tips

- Break down these market sizes using data that’s relevant to your startup. Investors want to see that your approach isn’t just broad strokes but is laser-focused on where you can actually make an impact.

- Use analogies that make these concepts digestible. Think of TAM as the entire ocean, SAM as the body of water where the fish swim, and SOM as the specific fish you can catch with your current resources.

Example

For a SaaS product targeting small businesses, TAM could represent the global small business market, SAM might be small businesses in your specific industry, and SOM could be those businesses in your target region who are currently underserved by competitors.

A – Analysis: Conducting Thorough Market Research

You wouldn’t build a house without a solid foundation, right?

The same goes for your market estimates. Without thorough market research, your numbers can come across as wishful thinking rather than realistic projections.

Actionable Tips

- Start with industry reports for a broad view, but don’t stop there. Dive deeper by conducting surveys or interviews with potential customers to validate your findings.

- Use a mix of top-down and bottom-up approaches. The top-down approach gives you the big picture, while bottom-up helps you ground your estimates in reality.

Example

Let’s say you’re entering the AI-driven business solutions market. Begin by examining industry reports for an overall market size.

Then, validate these numbers by analyzing the specific needs of small businesses in your target area through customer interviews.

R – Relevance: Tailoring Market Estimates to Your Startup

Generic market data is like trying to fit a square peg into a round hole—it doesn’t work.

Investors want to see that you’re not just throwing numbers around, but that you understand exactly where your product fits.

Actionable Tips

- Tailor your TAM, SAM, and SOM to your startup’s unique value proposition. This shows investors that your market estimates are grounded in reality, not just big dreams.

- Demonstrate how your product is designed to address specific needs within the defined markets.

Example

If your startup offers a digital solution for restaurants, don’t just talk about the entire foodservice industry.

Narrow it down to the type of restaurants that would most benefit from your product—maybe it’s fast-casual chains that struggle with inventory management.

K – Key Assumptions: Being Transparent About Your Assumptions

Investors hate surprises—especially when it comes to numbers. That’s why it’s critical to lay all your assumptions on the table.

Actionable Tips

- Be upfront about the assumptions that underpin your market estimates. This includes growth rates, customer adoption, and competitive landscape.

- Back up these assumptions with data or credible reasoning. The more transparent you are, the more confidence investors will have in your projections.

Example

If you’re assuming a 15% annual growth rate in the AI market, make sure to reference a recent report or trend analysis that supports this assumption.

E – Evidence: Backing Up Your Estimates with Data

In the world of investment, data is king. Without it, your market estimates are just numbers on a slide.

Actionable Tips

- Source your data from reputable industry reports, research papers, and expert analyses. Citing these sources not only strengthens your argument but also shows that you’ve done your homework.

- Include citations and references directly in your slide to make it easy for investors to verify your claims.

Example

If you’re estimating the size of the AI-driven business solutions market, cite a report from Gartner or Forrester to back up your numbers.

T – Timing: Seizing the Right Moment in Market Entry

Even the best product-market fit can fail if you enter the market at the wrong time.

Your TAM, SAM, SOM analysis should not only show the potential market sizes but also emphasize the optimal timing for capturing market share.

Actionable Tips

- Market Readiness: Assess whether the market is mature enough for your product or if you’re ahead (or behind) the curve. Timing your entry when market demand is growing can make or break your launch.

- Seasonality: Some markets have seasonal peaks and lows. For instance, launching a fitness product in January when health resolutions are in full swing can significantly boost initial traction.

- Competitor Movement: Analyze when competitors are making moves and find the sweet spot to either pre-empt or avoid overlapping with their big launches.

Example

If you’re entering the healthcare SaaS market, the timing of new regulations or compliance standards is crucial. Aligning your market entry with the implementation of new data security rules can position your product as a must-have solution.

Tailored Market Sizing Examples

- Early-Stage SaaS Startup:

- Focus: Timing is critical when launching in a fast-moving industry. Aim for a window when competition is low, but demand is on the rise.

- Highlight: If you’re offering a software solution for remote work, capitalizing on post-pandemic shifts when companies are still adapting to hybrid models could prove essential.

- Example: A SaaS product targeting e-learning can benefit from timing its launch at the start of the academic year, when schools and institutions are looking for new tools.

- Consumer Product:

- Focus: Leverage trends and cultural moments. Timing your product launch to align with trends in consumer behavior or health waves can help you capture market interest early.

- Highlight: For a fitness gadget, launching during New Year’s resolution season, when consumers are most inclined to invest in health, will give you a strategic edge.

- Example: If your product caters to outdoor activities, entering the market before summer vacations will allow you to capture the audience when they are most active.

- B2B Solution:

- Focus: Timing your product launch based on industry cycles can maximize impact. For instance, budgeting periods, fiscal year ends, or new industry standards can make or break your launch.

- Highlight: A supply chain management solution could see a stronger reception if timed with the implementation of new regulations or during a period of industry disruptions that highlight inefficiencies.

- Example: If your B2B software solves logistics issues, launching it when companies are facing global supply chain crises could make it an essential solution.

Ending Thoughts

By applying the MARKET framework, you can present a TAM, SAM, SOM slide that’s credible and compelling, giving investors the confidence to back your vision.

Remember, your market estimates are a reflection of your understanding of the opportunity ahead.

Use this framework as your guide, and ensure every number you present is grounded in thorough research and tailored to your unique value proposition.

Ready to sharpen your pitch? Connect with us to refine your strategy and make your market opportunity impossible to ignore.