The STAGE is set.

It’s time to step into the spotlight and blow the audience away. In this case, your investors.

Getting on stage can be similar to making a pitch to investors. Let us explain.

Your heart beats faster.

You don’t know how everyone will react.

You hope it goes well.

But think of this as an opportunity. Just as a performance can catapult an artist to worldwide fame. Your pitch deck can take your startup to the top.

All you need is investors to believe in you. How will you do that?

We will tell you exactly how to conquer your presentation jitters with the STAGE framework.

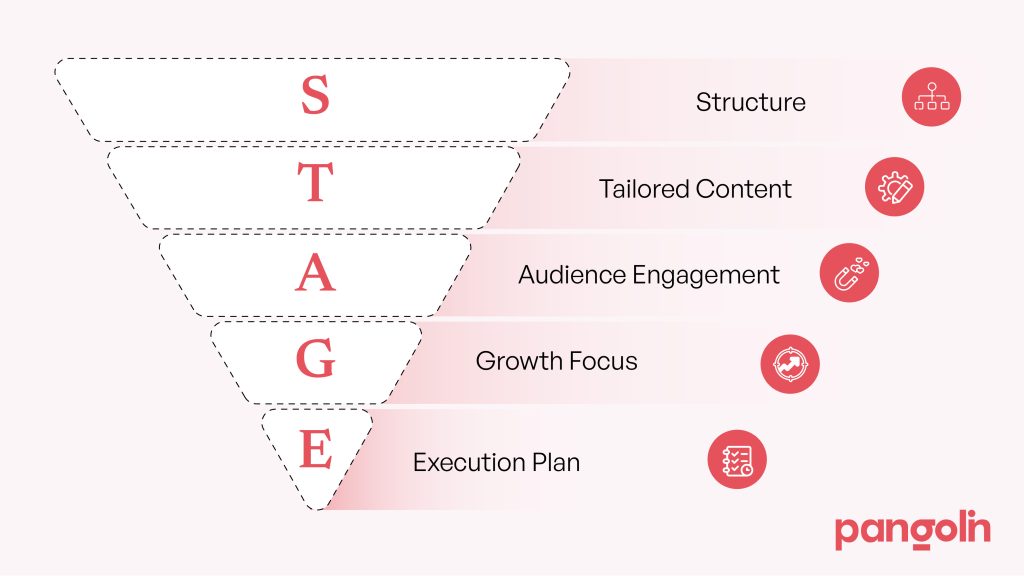

STAGE Framework, a practical approach to creating a pitch deck that ensures you present the right information at the right time, making it easier for investors to understand your startup’s potential.

Think about your current pitch deck—does it clearly communicate your startup’s value at its current stage, or is there room for improvement?

The STAGE Framework for Your Pitch Deck

When you’re putting together your pitch deck, the STAGE Framework can be your go-to guide to make sure your presentation isn’t just another deck that gets lost in an investor’s inbox.

S – Structure

Let’s be honest—if your pitch deck isn’t organized, you’re going to lose investors before they even reach the halfway point.

Start with the basics: introduce your startup, outline the problem, present your solution, then show the market opportunity.

It’s like building a house—you need a strong foundation before adding the walls and roof.

T – Tailored Content:

One size doesn’t fit all, especially in fundraising.

The pitch deck you used for your pre-seed round won’t cut it when you’re going for Series A.

For example, early on, you might focus on the big vision and your initial product. But as you progress, investors want to see more—like how you’ve nailed down your go-to market strategy and what traction you’ve achieved so far.

Think about what your audience needs to hear at each stage and tailor your content accordingly.

A – Audience Engagement:

Let’s face it, investors see dozens of pitch decks every week.

So how do you make sure yours doesn’t just blend into the background?

- Keep it simple and engaging

- Avoid the temptation to overload your slides with text or complicated charts

- Use visuals and tell a story

G – Growth Focus:

Investors aren’t just interested in what your startup is doing today—they want to know where it’s going tomorrow.

Maybe you’ve got 500 users now, but what’s your plan to get to 5,000?

If you’ve hit milestones, shout them out. And if you’ve got big goals, lay out the roadmap to get there.

E – Execution Plan:

It’s great to have a vision, but investors want to see you’ve got a concrete plan to make it happen.

Have you ever sat in a meeting and realized you were getting more questions about how you’re going to execute than about your actual product?

That’s because a solid execution plan is critical.

Show them you’ve thought about every detail—from your go to market strategy to how you’re going to scale your team.

Master each STAGE of your pitch and watch your startup take center stage with investors.

Different Stages, Different Pitches: Why Tailoring Matters

As your startup progresses from concept to growth, your pitch deck needs to evolve too.

Each stage of fundraising—whether it’s Pre-Seed, Seed, or Series A—comes with its own set of expectations from investors.

Investors at the Pre-Seed stage are looking for vision and validation. They want to know that your idea is solid and that you’ve taken the first steps toward making it a reality.

But as you move into the Seed stage, those same investors will be looking for proof of traction and a clear path to growth.

By the time you reach Series A, the stakes are even higher. Investors will expect a detailed plan for scaling your business and achieving long-term success.

This is why it’s crucial to tailor your pitch deck to the specific stage of fundraising you’re in. The information that resonates with investors at one stage might not be enough—or might even be irrelevant—at another.

So, how do you ensure that your pitch deck hits the mark at every stage?

Let’s break it down with the STAGE Framework and then see how the essential slides differ across Pre-Seed, Seed, and Series A rounds.

Key Differences in Pitch Decks: Pre-Seed, Seed, and Series A

| Slide | Pre-Seed Stage | Seed Stage | Series A Stage |

| Title Slide | Basic info: startup name, tagline, and contact details. | Same as Pre-Seed | Same as Pre-Seed |

| Problem | Broad problem statement, relatable and urgent. | Refined problem with updated data and insights. | Laser-focused problem statement backed by solid data. |

| Solution | Core value proposition, directly addressing the problem. | Enhanced solution with updates or new features. | Future development plans and updates to stay ahead of competitors. |

| Market Opportunity | Estimate market size (TAM, SAM, SOM). | Updated market analysis with deeper insights and trends. | Detailed analysis, including opportunities in adjacent industries. |

| Traction | Early traction (e.g., pilot programs, initial user feedback) | Detailed growth data, key partnerships, milestones achieved. | Detailed user metrics, revenue growth, and customer retention rates. |

| Business Model | Simple revenue model, e.g., subscription-based. | More detailed explanation with additional revenue streams. | Comprehensive breakdown of all revenue streams. |

| Team | Highlight founding team’s relevant experience. | Update to include new key hires or advisors. | Emphasize the team’s ability to scale, with new leadership roles |

| Finances | Basic financial projections, showing thought for future growth. | Detailed financial projections for the next 2-3 years. | In-depth projections for 3-5 years, with a clear path to profitability. |

| The Ask | Specific funding needs and how the money will be used. | Detailed allocation of requested funding. | Break down the funding needs with expected impact. |

| Milestones | N/A | Key milestones achieved and future goals. | Major milestones, risk mitigation, and exit strategy. |

| Risk and Mitigation | N/A | N/A | Address potential risks and how to mitigate them. |

| Exit Strategy | N/A | N/A | Outline potential exit scenarios (acquisition, IPO, etc.). |

Ending Thoughts

Remember, your pitch deck is a living document.

As your startup grows, so should your pitch.

Keep refining your problem statement, updating your market opportunity, and showcasing the traction you’ve gained.

Investors want to see progress and a clear path forward—show them you’re ready to scale and succeed.

Contact us today for more details.