Sell me this pen.

If you have seen the Wolf of Wall Street or heard of Jordan Belfort you know the significance of these four words.

It’s one of the most powerful lines when you’re trying to make a pitch. A pitch is all about making a good first impression.

You have to be confident. You have to believe in yourself. In short, you have to be so good that investors even buy a pen from you.

But why should you care as a startup founder? Because…

Fail to secure seed funding because of weak pitch decks. A powerful pitch deck can make or break your chances of success in those critical early stages.

The secret lies in understanding exactly what investors look for in a seed stage pitch deck. We suggest you start INVESTing.

Let us explain.

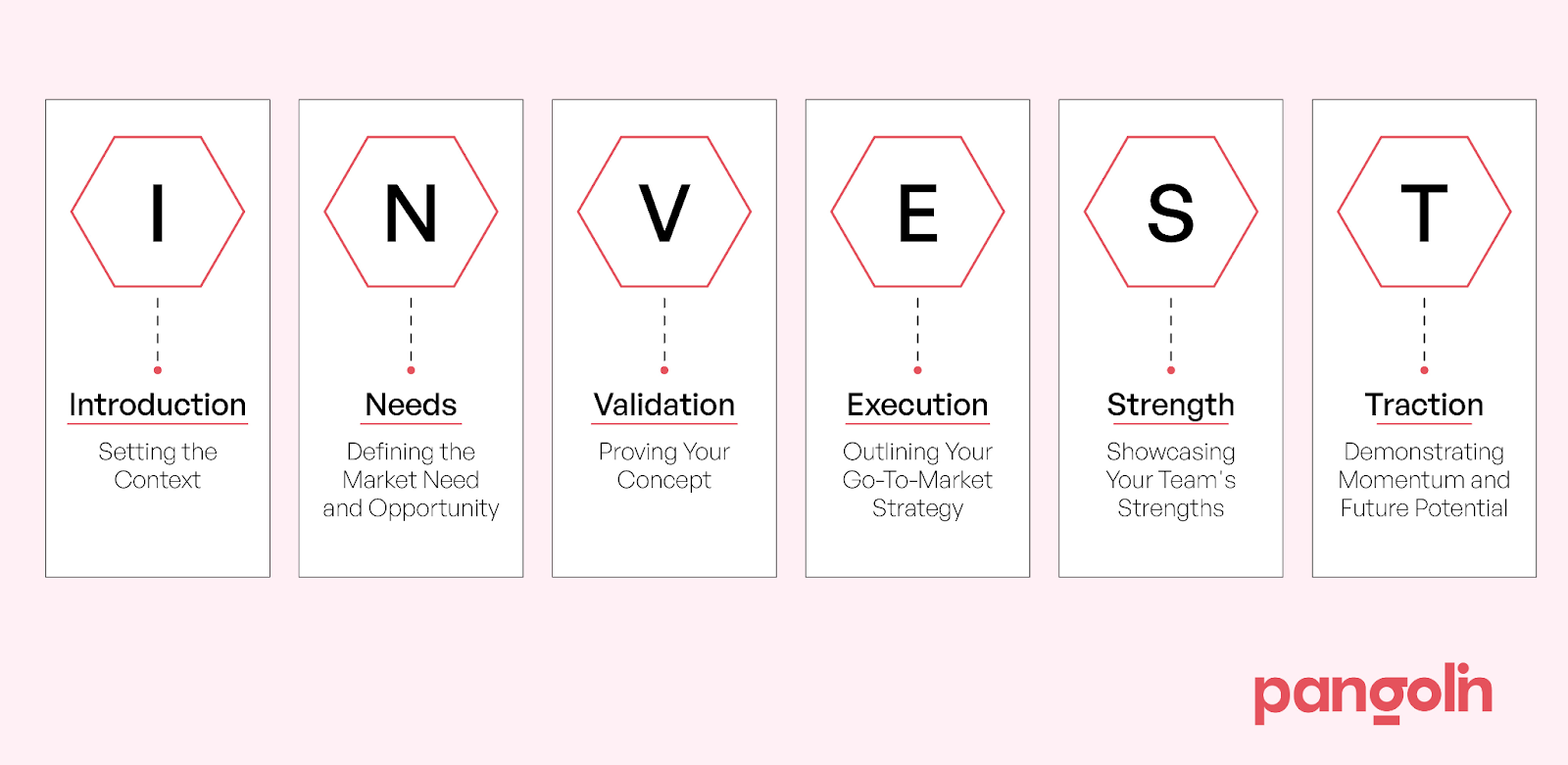

INVEST stands for Introduction, Needs, Validation, Execution, Team, and Traction. It’s a structured approach that ensures your pitch deck covers all essential aspects, presenting your startup in the best possible light.

I – Introduction: Setting the Context

There’s no point just talking about a great pitch. We will show you the INVEST framework in action, by pitching it to you. So, let’s start with the I – Introduction.

“We have helped startup founders raise $6 million in funding so far.”

As an opening statement, this is as strong as it goes. Moreover, it’s true. Pangolin Marketing has a successful track record of helping startups get seed stage funding.

Now, your opening, when pitching to investors, has to be this strong. It should set the stage for everything that follows or even the most innovative ideas will fall flat.

Almost 75% of investors get distracted in the first 10 minutes of a pitch.

Actionable Seed Funding Tips:

- Start with a Captivating Opening. Clearly state the problem your startup aims to solve. This immediately anchors your audience and highlights the relevance of your solution. For instance, “Many small businesses struggle with accessing affordable, AI-driven analytics tools that can drive growth and efficiency.”

- Highlight Your Vision and Mission Succinctly Right Away. Keep it clear and concise to keep investors hooked.

- Use a Compelling Anecdote or Data Point. A powerful story or statistic can make your introduction memorable. (Just like we did – your mind will fixate on $6 million instantly).

N – Needs: Defining the Market Need and Opportunity

When we say – sell us this pen – do you start by telling us it’s a great pen? Do you dive into the features and point out all that it can do?

No.

Ask the other person if they write letters to a loved one. Ask them if they are asking others to lend them a pen.

There’s your opportunity. Tap into the market demand and fill the gap.

Investors need to see that there is a significant problem your startup aims to solve and that there is a large, addressable market ready for your solution.

Clearly articulating the market needs helps investors understand the potential impact and scalability of your business.

Actionable Seed Funding Tips:

- Clearly Articulate the Problem and Its Significance. Be straightforward. Don’t beat about the bush. Show why this problem matters and the pain points it creates for your target audience. For example, “Small businesses often lack access to advanced analytics tools, which limits their ability to make data-driven decisions and compete with larger enterprises.”

- Present Solid Market Research. Define your Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). These metrics demonstrate the size and scope of the opportunity your startup is targeting. Provide concrete numbers and sources to back up your claims.

- Use Real-World Examples to Illustrate the Market Need. Make your argument more tangible and relatable, highlighting current market gaps and opportunities your startup can exploit.

V – Validation: Proving Your Concept

Why should investors believe you? You have to show them there is a demand for your startup.

Validation is critical in convincing investors that your startup has product-market fit. Demonstrating early traction shows that your business model is viable.

Actionable Seed Funding Tips:

- Present Early Traction. Highlight key metrics that demonstrate your startup’s growth and market acceptance. This could include user growth, revenue figures, or successful pilot results.

- Include Customer Testimonials or Case Studies. They provide third-party validation and make your claims more credible. We suggest sharing stories from satisfied customers who have benefited from your solution.

- Show Any Endorsements or Partnerships with Reputable Organizations. It will lend credibility to your startup and these associations can significantly boost investor confidence.

E – Execution: Outlining Your Go-To-Market Strategy

So, you have introduced your startup. You have pitched the problem you’re solving, validating it with relevant information.

Now, you might feel that the job is almost done. But not quite.

You have now got the investors attention. They know what you do, why you do it. However, they are more interested in how you will do it.

A detailed go-to-market strategy is essential for building investor confidence.

It shows that you have a clear, actionable plan for reaching your target market, scaling your business, and achieving your growth objectives.

Actionable Seed Funding Tips:

- Detail Your Go-To-Market Strategy and outline a clear, phased approach to market entry. Specify the steps you will take, from product launch to market penetration, and include timelines for each phase.

- Highlight Your Milestones and Key Performance Indicators (KPIs). This could include user acquisition targets, revenue milestones, or product development goals. For instance, a key milestone in your strategy could include reaching 1,000 active users within the first six months.

- Show Your Understanding of Customer Acquisition Costs and Sales Cycles. Investors need to know that you have a realistic view of the resources needed to grow your business.

S – Team: Showcasing Your Team’s Strengths

Always remember this – You’re pitching to people.

Too often startups go all in on their product. But remember you’re trying to solve a specific problem actual people are facing. So, be empathetic and show that you care.

Investors bet on people as much as they do on ideas. Highlighting your team’s capabilities is crucial because it shows that you have the right mix of skills and experience to execute your vision.

A strong team with a proven track record can significantly boost investor confidence.

Actionable Seed Funding Tips:

- Highlight the Relevant Experience and Skills of Each Team Member. Focus on their relevant experience and achievements that demonstrate their ability to contribute to your startup’s success. For example, your CEO might have over a decade of experience in SaaS, leading startups to profitable exits.

- Show How Your Team’s Background Aligns with Your Startup’s Needs. It shows that you have a well-rounded team capable of executing your business plan.

- Include Any Advisors or Key Hires that Strengthen Your Team. Mention their credentials and the strategic advantages they bring.

T – Traction: Demonstrating Momentum and Future Potential

And finally, everyone loves to go up the mountain but no one likes to come down.

Show that your startup is on a growth trajectory. Use concrete evidence of your progress, building trust to indicate that your business model is working.

It also highlights your potential for future growth, making your startup an attractive investment opportunity.

Actionable Seed Funding Tips:

- Present Clear Metrics Demonstrating Your Growth and Market Adoption. You could include user growth, revenue figures, customer retention rates, or other relevant metrics.

- Use Visual Aids to Highlight Key Achievements and Milestones. Incorporate graphs, charts, and infographics to represent your growth metrics and milestones. This makes complex data easier to understand and more impactful.

- Discuss Your Roadmap and How You Plan to Achieve Future Goals. Outline steps about upcoming product features, market expansion strategies, and key milestones.

INVEST Today!

Use this guide to create a compelling seed stage pitch deck. If you need more help, contact us today.